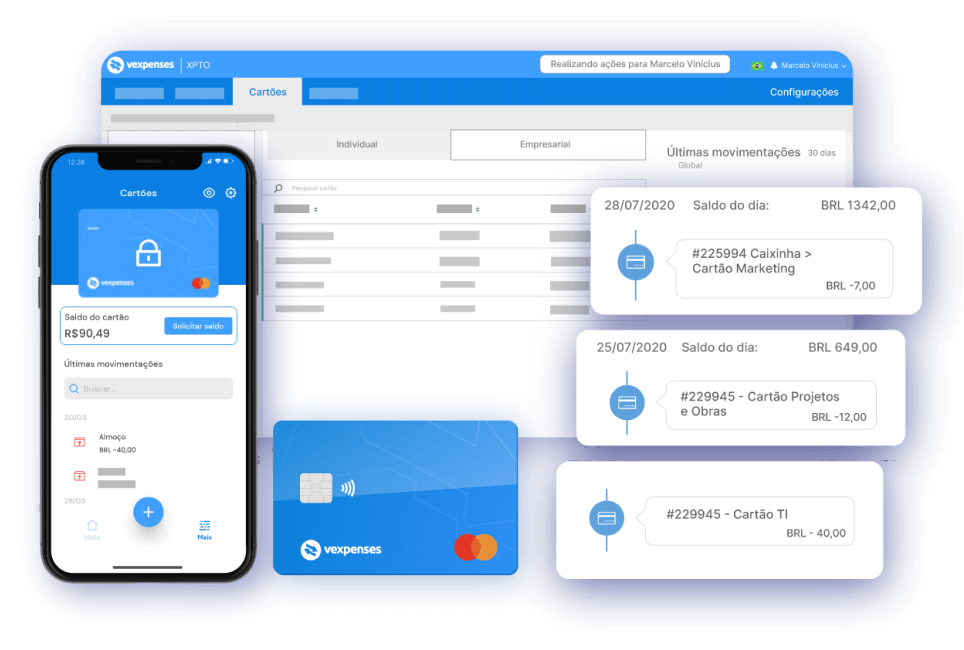

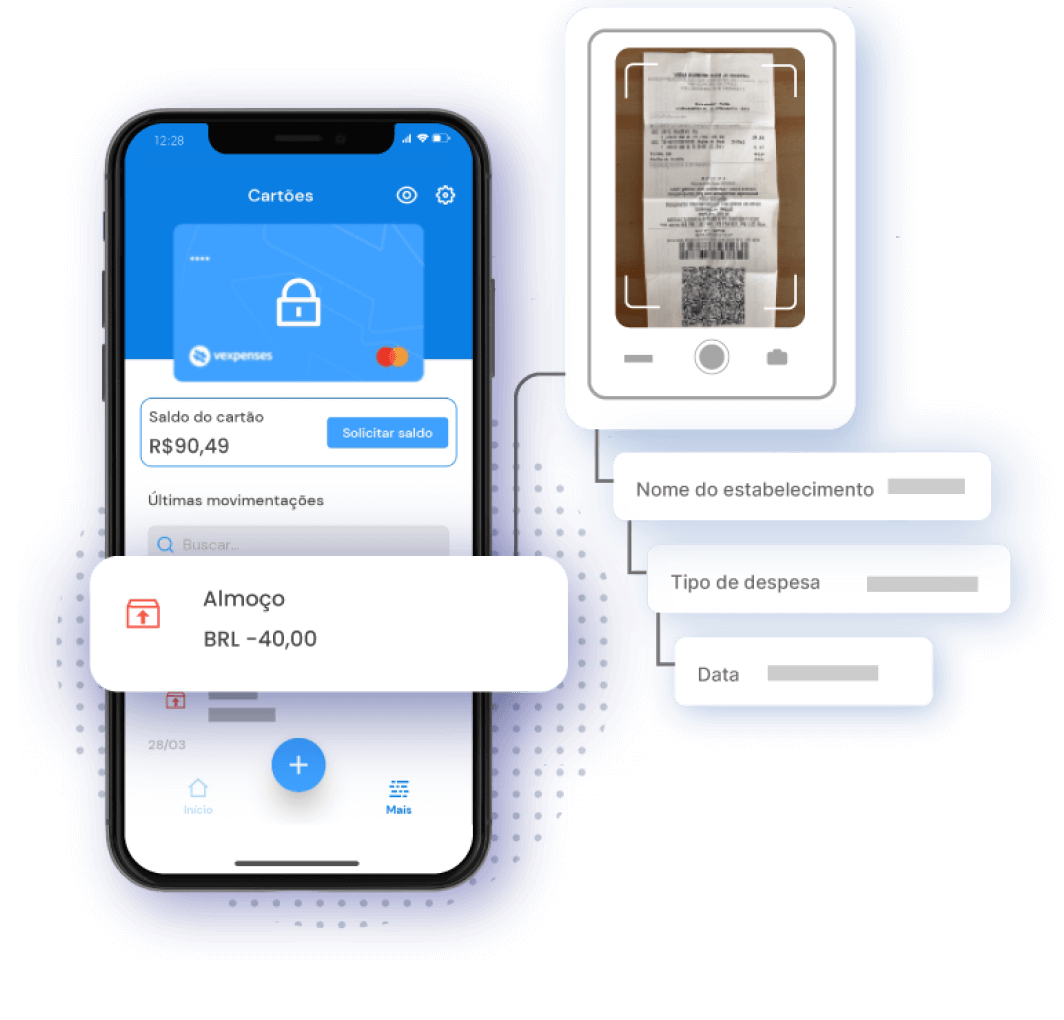

“By accounting for only the cost of transporting physical documents and their storage, we achieved a monthly savings of R$ 5.000,00.”

Today, with VExpenses, we no longer have paper files, nor do we incur expenses with postal services. In addition to an 87% time savings in this process alone, which now takes only two days from reimbursement request to payment.

Ourofino Agrociência

Anselmo Belodi Jr. - Financial Coordinator